Lately, it seems the world of growth hacking has taken off. With the introduction of things like GrowthHackers.com, Growth Hacker TV and other resources there seems to be a wealth of information surfacing on growth hacking.

Don’t get me wrong, I have certainly picked up a few tricks and I think it’s awesome that everybody is sharing their knowledge and all learning from each other. However, one thing i’ve noticed reading through a lot of this content is that there seems to be a significant focus on the what and the how, but not on the when. Do you think Air BNB would have come up with their infamous Craigslist hack if they didn’t know where their potential customers were searching online? Or do you think Hotmail’s ‘P.s I love you’ growth hack would have worked so efficiently if their visit site – activation funnel sucked?

Too me, all these tactics are awesome but they only worked so well because they were executed at the right time, and because the companies who executed them had gotten plenty of other things right beforehand.

So on that note, I want to present a framework I’ve been working on called the ‘4 stages of Growth hacking’ which I hope will help you understand some of the things you need to do before deploying the 100 growth hacking ideas you’ve picked up from all that reading you’ve been doing.

Stage 1: Learn

The first stage of the framework is getting a detailed understanding of your customers. I cannot over exaggerate how important this is to everything you are about to do. Without a detailed understanding of your customers, how can you possibly:

- Create effective messaging that resonates with your target markets by addressing their existing pain points and exposing core value proposition(s)

- Align your customer acquisition process with different customer buying cycles and buyer roles

- Find and scale customer acquisition channels that reach potential customers in the right place at the right time

In order to achieve this, you will need to conduct 4 types of in-depth customer interviews with different segments of your audience. The steps to doing this are as follows:

Step 1: Segment your audience

Segment A: Must Have and non-Must Have customers

In order to understand the true value proposition of your product and how people are experiencing it, you must first segment your customer base into those that consider your product a must-have and those that don’t. To do this, it is recommended you send a survey to your customer base. The survey has one question and 4 possible answers to which the user can respond;

How would you feel if you could no longer use our product?

- Very disappointed

- Somewhat disappointed

- Not disappointed (It isn’t really that useful)

- N/A – I no longer use the product

If you are confident you will get a large amount of responses, I would suggest using a Qualaroo survey and if possible, integrate it with your KISSmetrics setup. This will automate a lot of the follow up processes and allow you to do deeper segmentation, but will likely result in a decreased response rate.

Alternatively, if you are not confident you will get a reasonable amount of responses I would suggest emailing the survey question and having people simply respond with their answer. This will make processing this information more difficult but will likely result in a higher response rate.

Segment B: Recent Signups

In order to understand the triggers, the buying cycle and the information needs at each stage I would suggest creating a second segment of customers who have recently signed up for your product. If you have something like KISSmetrics or Mixpanel installed, you can easily create a list using these tools without bugging your developers.

Segment C: Recent Purchasers

In order to understand the ‘Activation’ point, what is triggering purchases and how to trigger more I would suggest creating a third segment of customers who have recently upgraded from a free plan to a paid plan. If you have something like KISSmetrics or Mixpanel installed, you can easily create a list using these tools without bugging your developers.

Segment D: Recent Cancellations

In order to understand the what is causing people to cancel and what can be done about it I would suggest creating a fourth and final segment of customers who have recently downgraded from a paid plan to the free plan or churned out altogether. If you have something like KISSmetrics or Mixpanel installed, you can easily create a list using these tools without bugging your developers.

Step 2: Interview your customers

When interviewing your customer segments, you will need to conduct 4 separate types of interviews in order to gain the deep insights needed to devise and execute effective growth hacks that move the needle on your key metrics. These include:

Interview A: Must have experience customers

For these interviews, you will speak with customers who answered ‘Very disappointed’ to the segmentation question. The following questions should be asked:

- Briefly describe your business, including size, primary expertise, location, etc.

- What is your role within the organization? What department does that fall in? How many people are in your team?

- What are your main goals and KPI’s?

- What are the main frustrations and pain points in your role?

- What do you use our product to achieve?

- Please briefly describe how you were achieving this before you found our product? What were the problems associated with this method?

- What is the main benefit you get from using our product?

- Can you briefly describe any other benefits you are getting from using our product?

- Where do you primarily get information and knowledge from? Blogs? Magazines? Tradeshows? Can you name them?

Interview B: Non-Must have experience customers

For these interviews, you will speak with customers who answered ‘Somewhat disappointed’ and ‘Not disappointed’ to the segmentation question. The following questions should be asked:

- Briefly describe your business, including size, primary expertise, location, etc.

- What is your role within the organization? What department does that fall in? How many people are in your team?

- What are your main goals and KPI’s?

- What are the main frustrations and pain points in your role?

- What do you use our product to achieve?

- Please briefly describe how you were achieving this before you found our product? What were the problems associated with this method?

- What is the main benefit you get from using our product?

- Can you briefly describe any other benefits you are getting from your use of our product?

- When asked how disappointed would you be if you could no longer use our product, you answered . Why did you not answer ‘Very disappointed’? What would have to happen for you to be very disappointed if our product went away? Is there anything preventing that from happening?

- Where do you primarily get information and knowledge from? Blogs? Magazines? Tradeshows? Can you name them?

Interview C: New Signups

This interview is conducted with new customers when they sign up for your product. It’s designed to capture information about who the buyers are, what triggers the buying cycle, what their information needs at each stage are, etc.

Questions include:

- Briefly describe your business, including size, primary expertise, location, etc.

- What is your role within the organization? What department does that fall in? How many people are in your team?

- What do you intend on using our product to achieve? What made you seek out a solution like ours??

- Where exactly did you first hear about our product?

- What persuaded you to signup for our product?

- When you arrived at our website, what were some of the key things you wanted to know before committing to signing up?

- What was your biggest fear or concern about using our product? Was there anything that almost stopped you from signing up?

- Where do you get industry information from? Are there any particular blogs/magazines you read? Do you follow certain certain people on social networks?

Interview D: New Upgrades/Purchasers

This interview is conducted with customers just after they have upgraded to a paid plan. It’s designed to capture information about who the buyers are, what triggered them to use your product, what triggered them to upgrade and more.

Questions include:

- Briefly describe your business, including size, primary expertise, location, etc.

- What is your role within the organization? What department does that fall in? How many people are in your team?

- What do you use our product for?

- Facebook defines the moment a user realizes the value in their product as having added 7 friends, Twitter defines it as having followed 15 people. At what point in time did you realize the value of our product? What actions had you taken up to that point?

- You were obviously on the free plan before upgrading, what made you upgrade?

- What persuaded you to choose (Insert plan name)? Why not one of the other plans?

- What was your biggest fear about signing up for a paid plan? Was there anything that almost stopped you from signing up?

- Where do you get industry information from? Are there any particular blogs/magazines you read? Do you follow certain certain people on social networks?

Interview D: Downgrades/Cancellations

This interview is conducted with customers just after they have downgraded from a paid plan to the free plan or churned out all together. It’s designed to capture information about why they downgraded/cancelled and how it could be prevented in the future.

Questions include:

- Briefly describe your business, including size, primary expertise, location, etc.

- What is your role within the organization? What department does that fall in? How many people are in your team?

- What did you use our product for?

- You were obviously on the paid plan before downgrading, what caused you downgrade to the free plan? Is there anything that could have prevented you from downgrading?

- Do you intend on continuing to use our product even on the free plan?

- Is there anything that might cause you to upgrade to a paid plan again?

- How happy are you with your experience with our product (1 to 10)?

- Where do you get industry information from? Are there any particular blogs/magazines you read? Do you follow certain certain people on social networks?

Step 4: Compile a report to document your findings

While it may seem like a waste of time, it is very important to compile a report summarizing the findings from the interviews as these learning’s will form the foundation of almost everything you do in the later ‘stages’ of the framework.

The goal of this report is really to surface any interesting and/or useful insights gained which could potentially form the basis of A/B tests and iterations in the ‘Optimise’ stage. While each report will be unique to your business and the insights gained, I would think it should answer some of the following questions:

- Are there particular types of customers who consider the product a Must Have? What are the common charactertistics between them? Department? Organisation Size? Team size?

- Who are the people that consider your product a must have? What are their roles & job titles? What are their goals & KPI’s? What are the pain points of their roles?

- How are the Must have customers using the product? How is this different to the non-Must Have customers?

- What were the Must Have customers doing before using the product? What were the pain points associated with this method?

- What are the main benefits the Must Have customers are getting from your product? How are these different to the non-must have customers?

- Why did the Non-Must Have Customers not answer ‘Very disappointed’ to the survey question? What would have to happen for them to be very disappointed if our product went away? Is there anything preventing that from happening?

- Where do the Must Have Customers primarily get information and knowledge from? What blogs are they reading? Magazines? Tradeshows?

- What triggers people to sign up for our product? Are they trying to solve a particular problem? Or hearing about it somewhere and signing up to see what it’s like?

- When visiting the website, what are the things they need to know before signing up? Was there anything that almost prevented them from signing up?

- What is the Activation point? When are people realizing the core value of your product? What actions does it take to get people there?

- What is causing people to upgrade? Is it just that they hit the free plan limitations (assuming you have a freemium model) or are they upgrading to get premium features?

- Is there a particular type of customer that is upgrading more frequently? Is there a particular use case that is causing people to upgrade more frequently?

- What is causing people to hit free plan limitations?

- What is causing people to downgrade or cancel? Is it just that they no longer have use for your product or are there some common themes about functionality/capabilities of the product that are related to downgrade/cancellation?

- Is there a particular type of customer that is downgrading more frequently? Is there a particular use case that is causing people to downgrade more frequently?

Stage 2: Develop

In stage 2, the focus is on developing a marketing technology stack that allows you to achieve the following:

- Identify the most severe blockage points in your customer acquisition and retention funnel

- Identify what is causing these blockage points and what can be done to improve the conversion rates at each stage.

- Quickly devise and implement ‘experiments’ to help improve those conversion rates.

- Identify channels that are driving customers with positive ROI, and scale those channels appropriately.

Having done this for a few companies now, I have personally developed a bit of a ‘favourite stack’ which includes the following tools:

- KISSmetrics – KISSmetrics is everybody’s favourite lifecycle analytics tool. It is a great tool for identifying the most severe blockage points in the funnel and (to some extent) what is causing them. It is also awesome for identifying the channels that are driving customers at a positive ROI. It is however, only as good as the data you put into it and the way you architect it which can be fiddly. See another one of my articles for more info on the metrics you should be tracking.

- Qualaroo – Qualroo is (now) the brainchild of growthhackers.com founder Sean Ellis. It is a great tool for getting insights on your users and I like to use it to help identify why someone is getting stuck at a particular point in your funnel and then devising A/B tests to solve the blockage.

- HubSpot – This one is potentially out of reach for a number of organisations owing to its cost, but if you can sneak it under your budget it’s awesome. I use it for everything from lead nurturing & email marketing to social media marketing and SEO monitoring. If you’ve got a sales team selling your product then it’s a must.

- Optimizely – A great tool for running A/B tests on your website or application. Once I’ve identified a blockage point using KISSmetrics and theorised on the reasons for it (using mainly Qualaroo and interviews), I use Optimizely to rapidly deploy A/B tests to see if i can improve the conversion rate and kill the blockage. It integrates nicely with KISSmetrics so you can see the full lifecycle of users who passed through one of your A/B tests and understand the real effect of the test (rather than the immediate ‘Did they click X’ effect).

- Google Analytics – An oldie but a goodie. I use Google Analytics primarily to see how people are interacting and moving through our marketing site. If you setup goals (I.e. signup) correctly, the Goal Flow report is amazing for visualising how people went from visit to signup and can generate a lot of good insights for A/B testing.

All of these tools have the ability to take in custom data from your application and website and use it to enhance the capabilities of the tool. For instance, you can pass events people have done (I.e. Signed up but not Activated) to Qualaroo and deploy a survey asking them what stopped them from Activating.

In order to pass in this data, you need to integrate them with your website and application which can be time consuming. A great tool i’ve found to help you with this is Segment.io. Segment.io is basically a middleware application which allows you to integrate your app once and it then passes the data to a multitude of different tools (47 at last count) at the flick of a switch. Here’s how I use it at Dubsat:

By using Segment.io, we can instrument our website & application with their JS code once and suddenly we’re integrated with 47+ other applications which we can turn on and off at the flick of a switch. On top of that, Segment.io handles all the updates and issues with the different application providers which means significantly less ongoing maintenance to keep the integrations singing. Look out for my face on their ‘Customers’ page when you sign up 🙂

Stage 3: Optimise

This is where it starts to get fun. You should be able to use the insights you got from Stage 1 and combine that with the data you’re getting from implementing stage 2 to devise and run some really effective experiments based on deep customer insights.

The goal of this stage is to optimise your customer acquisition and retention funnel so that you get as many customers out the bottom of the funnel as possible. The reason we put this as Stage 3 is because without completing 1 and 2 you would have no idea what experiments to run, where if you try to skip this stage and go direct to 4 you simply won’t be able to convert visits into customers at good enough ROI.

Rather than suggest a bunch of different growth hacks you should try (your new insights should tell you that look at growthhackers.com or growthhacker.tv if you want ideas), I want to outline the process we go through in order to devise and deploy ‘experiments’ to help optimise the funnel.

- Find the biggest blockage point – Use the analytics tool you developed in Stage 2 to analyse your funnel and identify where the biggest blockage points are. This will become the single metric you will focus on for now. For the purpose of the article, we’re going to assume it’s the conversion rate between Visit Website and Signup.

- Set a goal state – You need to set a goal state in order for you to map your progress. A goal state should be specific, measureable and attainable such as ‘5% visit site – signup conversion rate’. An effective way of setting a goal state is to visualize the funnel in an excel spreadsheet and make modifications to the metric in question to see its effects on the rest of the funnel, and then compare this to growth objectives.

- Set a timebox – Generally, testing and experiments suffer from the law of diminishing returns in that the closer you get to a perfect state the less effective your experiments become. Set a timebox limit that allows for enough experiments to be carried out but keeps progress in line with business growth projections.

- Identify reasons for dropoff – Use Qualaroo and/or customer interviews to identify why people are dropping off at that particular stage. Did they not understand what to do next? Was it too difficult? By finding out these key insights, you can develop A/B tests that have a much better chance of moving the needle than just randomly changing button colours or moving things around.

- Develop falsifiable hypotheses – If you’re not familiar with the term Falsifiable Hypotheses, they are hypotheses that are specifically worded so that they can either be ‘proven’ or ‘falsified’. A good example would be ‘Adding customer logos to the home page will improve signup rate to 5%’. As you can see here, this one sentence defines the experiment you are going to run as well as the expected result. Ash Maurya provides a brilliant template for creating and documenting falsifiable hypotheses and i’d thoroughly recommend checking it out over at his blog.

- Carry out experiments – This will differ largely based on the type of experiment you are conducting.

- Record results and learnings – Regardless of whether an experiment returns a positive result in the key metric, it is important to document the results and any learnings you may have received from it. This will not only help you to document the process, but will allow you to build up a library of learnings you can refer back too. The same template for falsifiable hypotheses (The Experiment Report from Ash Maurya ) can be used for documenting results and insights.

- Iterate and Repeat – The final step of the process is to use the learnings and results from the previous experiment to iterate on the overall plan, modifying any upcoming experiments or changing priorities based on the new information. If relevant, you should also update the buyer personas as well.

Stage 4: Scale

By stage 4, you should have the following in place:

- A deep understanding of your customers, including their pain points, goals & KPI’s, where they’re hanging out online and more.

- An effective customer acquisition process capable of effectively converting website visitors into paying, engaged customers.

- A data-driven understanding of the effectiveness of each marketing channel used to drive website visitors

Based on this, you can begin to focus more on scaling channels proven to return a positive ROI on every marketing $$ spent.

This is where you can start to get creative and implement some of the great growth hacks and ideas you have, as you will now have the underlying capabilities to make them work for you.

Whilst only you will know which ‘tactics’ are going to work for your product, I have included some ideas below which are old favourites:

SEO

Although not the sexiest channel when compared to all the genius growth hacks you’ve been reading about, majority of the SaaS companies I have worked or consulted for still considered SEO one of their primary channels.

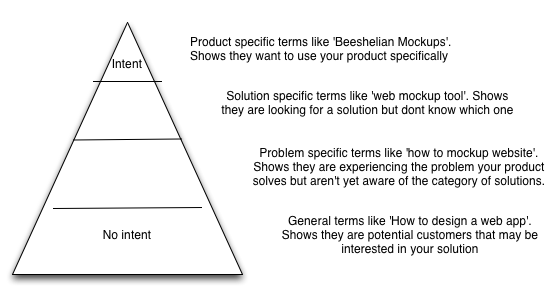

It’s likely that you are already doing well for terms at the top of the ‘Intent Pyramid’, but I believe there is always an opportunity for traffic growth further down the pyramid (I use a fictitious online mockup tool called ‘Beeshelian mockups’ to demonstrate):

The best way to go after these bottom of pyramid terms, is to first identify what they are and then begin creating a lot of high-quality blog content around them.

Free User Marketing

In my opinion, freemium is a marketing tactic and free users should be leveraged in an attempt to acquire new customers.

Consider how you could use your free customers to spread the word about your product? Can you brand a public-facing aspect of your product (emails, embeddable widgets, etc)? Can you incentivise users to share their love for your product over social networks (like how Dropbox gives you extra space for tweeting about Dropbox)?

Guest Blogging & Influencer Marketing

Particularly in communities who congregate online (which is almost everybody these days), Influencer marketing and guest blogging can be a highly effective way of increasing awareness of your product and driving traffic (it helps significantly with SEO too)

In order to do this, you must first build a comprehensive list of influencers. Some great tools to help you identify influencers with your niche include:

- Followerwonk

- GroupHigh

- WeFollow

Once you have identified the influencers, begin a stage of passive engagement whereby you actively participate in conversations with them around their content but do not ask for anything in return. This can include:

- Following them on social media

- Retweeting them on your social media accounts

- Commenting on content on their blogs (which also builds SEO)

- Sharing their blog posts via your social media accounts

Once you have nurtured relationships with these influencers, you can then begin engaging with them in an attempt to leverage their audiences. This can include:

- Asking them for feedback on your blog and how it can be improved

- Getting them to write content for our blog (may need to be paid at first) and sharing that content with their social media followers

- Pitching guest blogging opportunities and contributing guest posts to their blogs

- Co-creating or contributing to cornerstone content pieces you create (such as eBooks) and then promoting it (through guest posts, social updates, etc.) to their audience.

The guys at Groove wrote a great post on building relationships with influencers and I would recommend beginning the engagement process early as it will take some time to build the relationships up.

Product Integrations

What other applications are members of your target market using? Is there a possibility to integrate with some of those applications and drive traffic through their ecosystem?

In a recent interview with Growth Hacker TV, Unbounce’s marketing director Georgiana Laudi said they largely built their business through integrations and creating an ecosystem of applications that all work together.

I recommend exploring whether this could work for your product. Start by making a list of applications your customers use that you could potentially integrate with and start reaching out to them to ascertain levels of interest and possibilities. Once you understand what’s possible and the opportunity that exists, you can make a business decision as to whether this is a scalable acquisition channel worth exploring.

Cross-promotion partnerships

Can you potentially partner with other applications who have a similar target market to do some cross-promotion?

This could be anything from submitting guest posts on each others blogs to doing a discount promotion where you email each others user bases offering discounts for each others products.

Again, build a list of complimentary (but not competitive) products and reach out to their marketing team to ascertain levels of interest and scope the opportunity. Then make a call on whether this is an acquisition channel worth exploring.

Niall Conway

07.12.2015 at 19:54Great article Aaron. Keep up the good work.

Niall